Ever applied for a commercial mortgage loan? Then it is known that getting a commercial mortgage loan from a traditional institute is a challenging and tiring job. The waiting periods sometimes get too long, and the deals are lost.

But with the change of time, the process is getting faster and more accessible leading to easy contact with the hard money lender.

How do Hard money loans work for Commercial Real Estate?

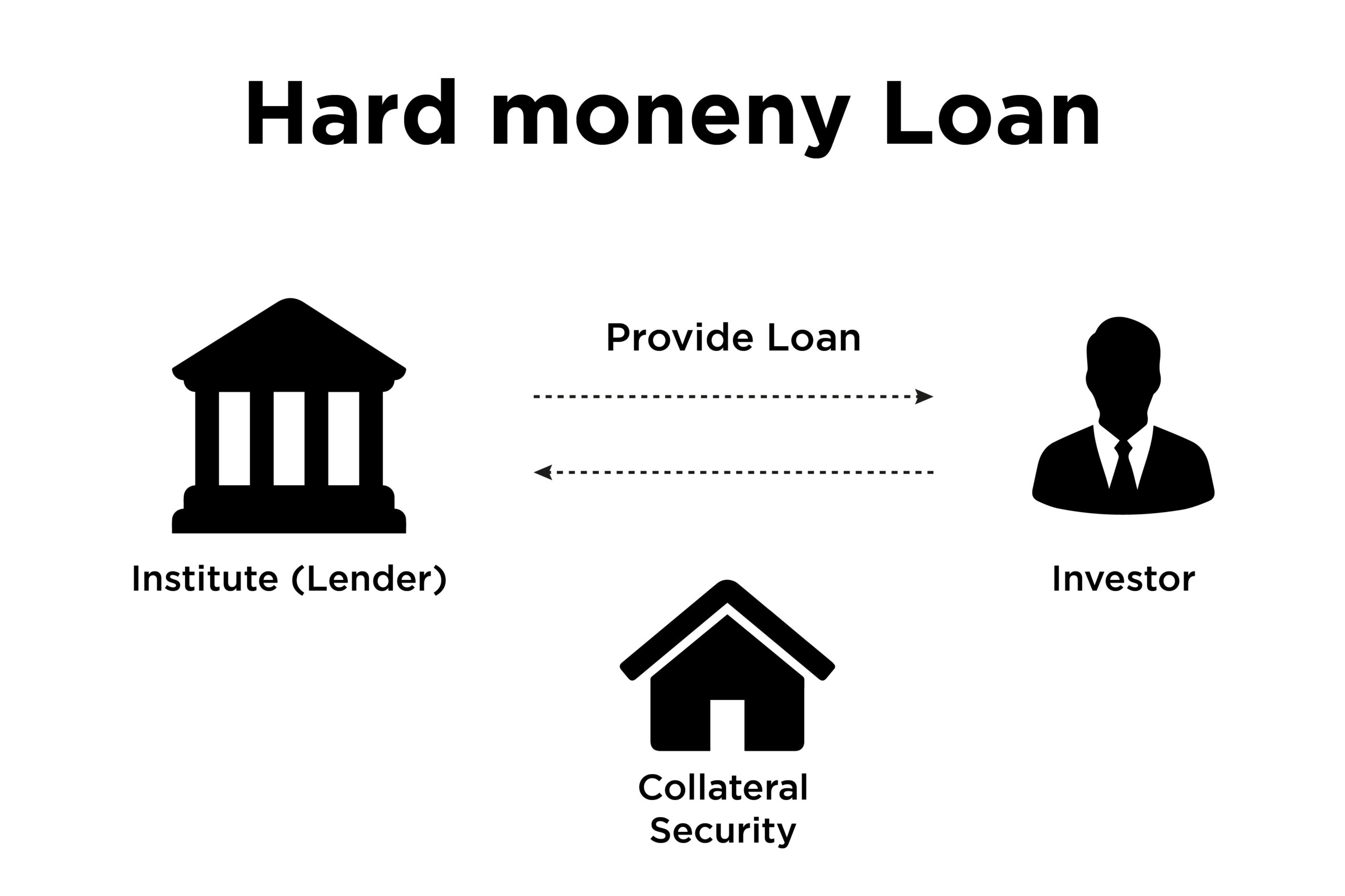

Hard money loans are short-term instruments used by property investors primarily in flipping and real estate development projects—ideally used for renovating or developing the property and then selling it for profit. Instead of traditional options, private or individual investors offer hard money commercial mortgages.

After checking the commercial property value, the lender decides whether to approve the application or reject it. The main focus is upon the after repair value or the estimate for the funding.

There are many benefits of hard money loans in CRE, but it’s not everyone’s cup of tea. The major drawback of hard money loans is that the rates can go up to 10% or higher compared to conventional options. Apart from this, one needs to pass different things such as orientation or closing fees. The repayment period is also low.

This type of investment is done by investors who have a commercial property to renovate or develop to resell it in the market as early as it could be. Therefore for hard money loan, complex money financing and a good business plan is required.

PROS OF HARD MONEY LOAN:

Although having certain drawbacks, seasonal commercial real estate investors take advantage of hard money loans as the latter provides an excellent benefit that is missing with other financing options.

So, let’s count the pros of using hard money loans.

Faster turnaround time:

After the Dodd-Frank Act is applied for the mortgage, the banking institution has laid out regulations that the lender must follow before lending out the amount. It can take around two months to close on a commercial mortgage loan, leading to the loss of sensitive projects.

However, the funding can be available fast with a hard money loan. It can be available within days. This quick turnaround proves to be advantageous in finding significant projects which are non deviated before the completion time.

Flexible terms and rates:

There is a possible chance for negotiations when opting for a hard money loan. The private lenders allow customized repayment schedules based on business requirements and plans. Reducing or eliminating the fees or other associated costs is done during the underwriting process.

Possibility for borrowing more:

According to banking institution laws, borrowers who can put down 20% of banking property’s purchase price are welcomed. Anything less than that will let the borrower get mortgage insurance increasing the monthly payment. Some investors provide complex money financing and 100% purchase price depending on the project’s profile.

Flexible collateral:

The commercial property is collaterally used to sanction the loan amount in the hard money mortgage, allowing the lenders to leverage the borrowers. For example, they let the assets such as residential property or retirement account be used to secure the loan.

Hope for rejected loans:

If the banking institution rejects investors applications because of unsteady cash flow or unworthy credit, they can apply for hard money loans. The lender can provide the amount of finance needed by the investors, but the interest rate will be undoubtedly high.

Access to better knowledge:

Getting financial help from the best institution in the real estate field will prove to be more fruitful. Banking institutions are not interested in property investments, but hard money lenders are. They are the only one who focuses locally and analyzes the market space. So from advising to showing the viability of the investment, they focus on the success of t so that their funds are safe and they can benefit from your success.

A great option to start:

Real estate investors find it pretty hard to raise capital independently. Here the hard money loan allows buying a property without spending significant funds.

The hard money loan helps the commercial property investors be reliable, letting the financial institution lend them. The conventional option will undoubtedly lower interest rates, establishing a good relationship with lenders.

When the investors come in good books of the institutions, the latter willingly starts to work with the former on future projects. They reduce the orientation fees or lends a higher percentage of the property’s purchase price.